Kellè news

Iscriviti alla newsletter per ricevere aggiornamenti su eventi, collezioni e promozioni esclusive.*Acconsento al trattamento dei dati forniti ai soli fini promozionali da parte di Kellé Capri.

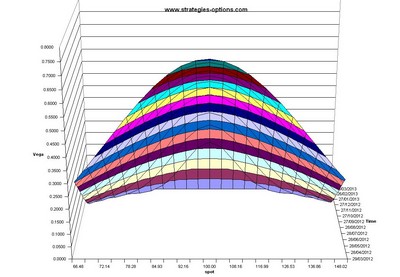

Both Technical and Fundamental analysis are techniques used by investors globally to make stock related decisions. Technical analysis differs from fundamental analysis, in that traders attempt to identify opportunities by looking at statistical trends, such as movements in a stock’s price and volume. The core assumption is that all known fundamentals are factored into price, thus there is no need to pay close attention to them. Technical analysts do not attempt to measure a security’s intrinsic value. Instead, they use stock charts to identify patterns and trends that suggest what a stock will do in the future. New sources of big data, in particular, can be used to find unique insights.

Weekly Forex Forecast – NASDAQ 100 Index, EUR/USD, USD/JPY ….

Posted: Sun, 14 May 2023 07:00:00 GMT [source]

Please validate that you are an investment professional by submitting your business email.

So while it is possible to trade financial markets using just the technical approach, it is doubtful that anyone could trade off fundamentals alone with no consideration of the technical side of the market. The time difference between the two analyzes is obvious not only from their point of view but also from the purposes where the technical analysis is about trading and the fundamental one is about investment. Investors tend to base their buying and selling decisions on fundamental analysis, while traders rely on technical analysis to profit in the short term. It is a method that is often used by traders and investors to make decisions about when to buy or sell a security based on price movements in the market.

The technician, of course, believes that the effect is all that he or she wants or needs to know and that the reasons, or the causes, are unnecessary. As standalone methods, good technical analysis is certainly more profitable than fundamental analysis. However, technical analysis can be made more profitable by adding elements of fundamental analysis.

In summary, fundamental analysis is concerned with the intrinsic value of a security, while technical analysis is concerned with identifying patterns and trends in price and volume data. Each approach has its strengths and weaknesses, and many investors use a combination of both approaches to make investment decisions. All chartists use price charts – usually either line charts, bar charts or candlestick charts. Some analysts use indicators like moving averages and oscillators calculated from stock prices.

Weekly Forex Forecast – NASDAQ 100 Index, EUR/USD, GBP/USD ….

Posted: Sun, 07 May 2023 07:00:00 GMT [source]

Technical analysis follows the concept of there is no real value of stock, it is all dependent on the demand and supply market forces. These market forces are then governed by both rational and irrational factors. Fundamental analysis is carried out by a long-term trader, and technical analysis – is by a short-term day and swing trader. Fundamental analysts focus on a company’s sales, profits, and related data to determine if it is a good buy.

Fundamental Analysis refers to the detailed examination of the basic factors which influence the interest of the economy, industry and company. Both technical and fundamental analysis have their own pros and cons but if I were asked to advise any trader on which one to focus on first, it would be technical analysis. This is because although fundamental analysis can be a powerful tool, it is very challenging and usually needs the application of technical analysis for timing of trade entries and exits. It is possible to make money with technical analysis alone, but very hard to do so with fundamental analysis alone.

The fundamental analysis method examines securities with the aim of determining their intrinsic value for investment opportunities over a long period. By contrast, the technical analysis method is estimating and forecasting the future price of a security based on changes in prices and transaction volumes. Technical analysis and fundamental analysis typically have different goals in mind. Technical analysts often try to identify many short- to medium-term trades where they can flip a stock, while fundamental analysts usually try to make long-term investments in a stock’s underlying business.

Fundamental analysis is time consuming – each company must be studied independently and in detail. Most of the information used in fundamental analysis is widely available. To gain an edge with fundamentals, you need to find unique datasets that aren’t available to most investors. differentiate between fundamental and technical forecasting Initially, the fluctuations in the stock price are examined to gain insights into how the price will evolve in the future. The price at which the buyer and seller agree to finalize the transaction represents a value that incorporates and reflects all relevant factors.

Also, decisions based on fundamental analysis typically have a higher probability of being correct, particularly over the long term. Fundamental analysis in the stock market is a method of evaluating a company and determining the intrinsic value of its stock. Companies are valued as though they were unlisted, with no regard for their market prices. Buy and sell decisions are then made based on whether a stock is trading at a discount or a premium to its fair value. The idea behind technical analysis is that there are predictable patterns of behaviour that can be found in the price movements of a security’s trading history. These patterns are typically represented visually by what are called “charts.”

If you are a value investor, there is no perfect way to analyze a stock. Even so, many successful investors will tell you that focusing on certain fundamental metrics is the path to cashing in on potential gains. Support is defined as areas where buyers have stepped in before, while resistance are areas where sellers have impeded price advance. The opinions expressed are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

Fundamental analysis does not involve the process of finding out past price trends and the faced fluctuations. Technicians however, believe that past trends will be re-current and will probably occur again. In technical analysis charts and tools with trends are used to create conclusions on the price movements. Prices and patterns are scrutinized through the provided statistics using indicators such as moving averages, odd lots, pull or call ratios and Fibonacci levels.

Lehner Investments is a leader in the field of combining systematic trading, artificial intelligence and big data. In the case of Lehner Investments Data Intelligence Fund, trading strategies employ user generated data combined with market data. This gives the fund an edge by measuring market sentiment in real time and identifying profitable trades. We can expect the lines between fundamental analysis and technical analysis to be blurred further as the investment industry evolves. Because the technical approach includes the fundamentals, the study of those fundamentals are not necessary — they are already reflected in the market price.

Fundamental analysis is a method of assessing the intrinsic value of a company or asset by analyzing various qualitative and quantitative factors that can affect its performance. Both of these approaches to market forecasting attempt to solve the same problem, that is, to determine the direction prices are likely to move. The fundamentalist studies the cause of market movement, while the technician studies the effect.

Trading Fuel is the largest stock market blog, offering free trading ideas and tactics for the Indian stock market. We cover topics related to intraday trading, strategic trading, and financial planning. On the other hand, the technician develops increased confidence in their ability to read the charts after a while. They learn to be comfortable in a situation where market movement disagrees with the so-called conventional wisdom. They know that the reason for the market action will become common knowledge — but they don’t need to wait for that added confirmation.

Also called intrinsic analysis, it helps people decide if the company’s services or products are beneficial to the public—and therefore worth investing in. In this post we explain the differences and highlight the strengths and weaknesses of each. We also list a few ways the two approaches can be combined, and what the future holds for the various forms of investment analysis.

Non ci sono prodotti nel carrello.